Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

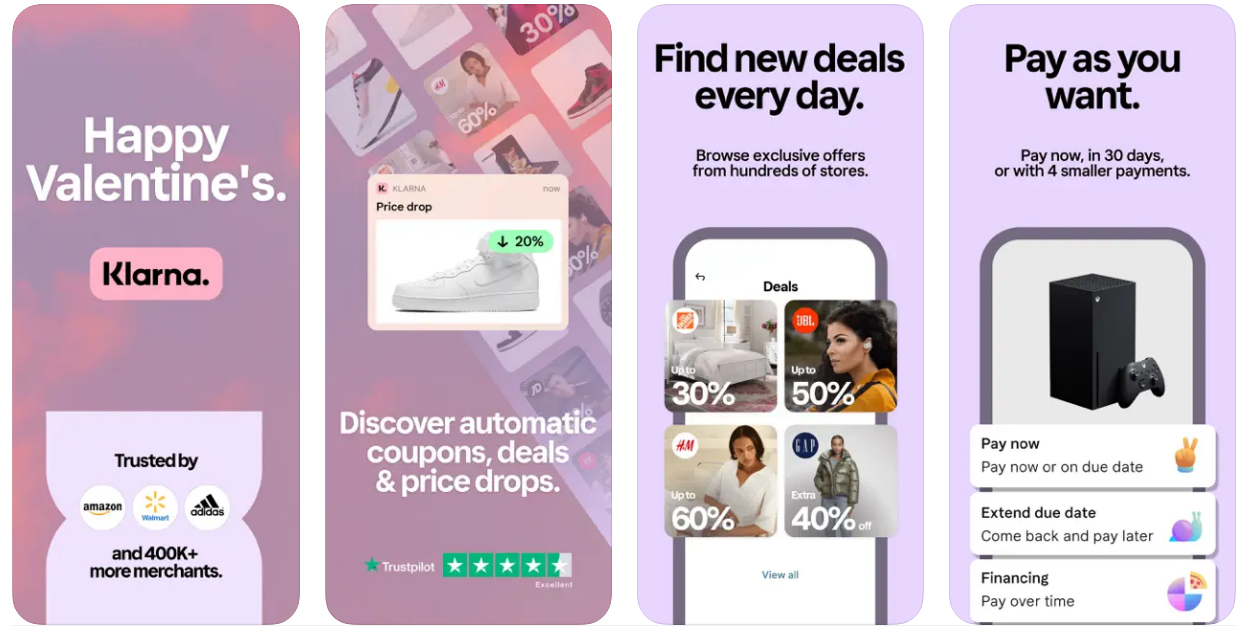

| Klarna |

Downloads: 255.1 MB | Rating: 4.5 |

Version: 23.6.197 | Updated: Feb 17, 2023 |

Category: Shopping | Offered By: Klarna Bank AB (publ) |

Whether you’re shopping online or in-store, the Klarna app allows you to manage payments and returns, access your credit card, and get instant price drop notifications. You’ll also have access to a curated Collection of items, as well as live shopping events and sponsored deals.

Klarna is a Swedish company that helps people buy things they can’t afford today. Its app works with most credit cards and allows users to make purchases using an interest-free payment plan. It also allows users to check spending trends and sell old items. However, it can also lead to impulse purchases.

Whether you are new to the Klarna system or are looking for a better way to manage your finances, it is important to know how it works. The price varies by country, but there are also options for payment and merchant fees, which are discussed in this article.

Using Klarna’s payment options is a smooth and simple way to pay for products and services online. Klarna offers a variety of payment options, including the Buy Now, Pay Later option, which allows customers to pay for their items in three or four equal installments.

Unlike other payment options, the Pay in 4 option allows customers to spread their purchases over four payments. This allows customers to split their costs into four easy payments without any interest. The system will automatically split your purchase into four equal payments every two weeks.

The Pay in 4 option is available to customers in certain countries, such as the U.S., France, and Spain. In order to take advantage of the Pay in 4 option, customers will need to be over the age of 18. Also, customers will need to provide an e-mail address and a mobile phone number.

Whether or not you should use Klarna merchant fees is a personal decision. There are many factors to consider before making a decision. These include your business model, the average order value, and your customer base.

If you sell mainly online, you may be interested in using Klarna’s payment system. This includes retailers such as electrical, beauty, homeware, and fashion retailers.

You can use Klarna’s online application form to sign up. This will allow you to receive API credentials that you can use to integrate with other services.

Using a ‘buy now pay later company can be a great way to avoid debt and stay on track with your spending. However, not every company is created equal. Depending on your credit score and spending habits, a company like Klarna may be right for you.

While it may be a good idea to use Klarna if you are planning to purchase an expensive item, it can also lead to unnecessary spending outside of your means. It’s also possible to run out of money and have to resort to using a credit card instead.

Whether you’re a small business or a global retailer, using Klarna can help you expand your business into new markets. With its flexible payment options, you can accept payments in different currencies.

Customers can make payments using their online banking account. Alternatively, you can offer a payment method that customers can pay for later. This could increase conversion rates and give shoppers a more local experience.

Depending on the country in which you’re doing business, you may also offer a payment option such as a credit card. However, you should note that if you use a credit card, you may have to pay late fees.

If you’re planning on offering a pay-later option, you may want to consider the price of Klarna. The pricing depends on the customer’s country. For example, in the United States, you may have to pay a higher fee than you would in Europe.

| Klarna Free App Download |